Working at Indium Corporation has been an eye opening experience into the realm of manufacturing and all that it has to offer. When I first was notified about my position at Indium Corporation in early April, I was ecstatic! I told all of my family and friends about my achievement and how excited I was. One of the most common questions I would get when telling people about my internship was, “Is it a paid internship?” I assured them that I wouldn’t have applied for the internship had it been unpaid. If it wasn’t paid then I wouldn’t be able to continue to contribute to my Roth IRA.

Many of you probably already know what a Roth IRA is, but for those of you that don’t, here is a brief overview. I will include a link to a more detailed explanation if you would prefer to learn more. A Roth IRA is a retirement fund that can be set up by an individual where you can deposit post-taxed money. That is a very oversimplified explanation, so I recommend that you read further on the topic with the links I have provided to get a better understanding.

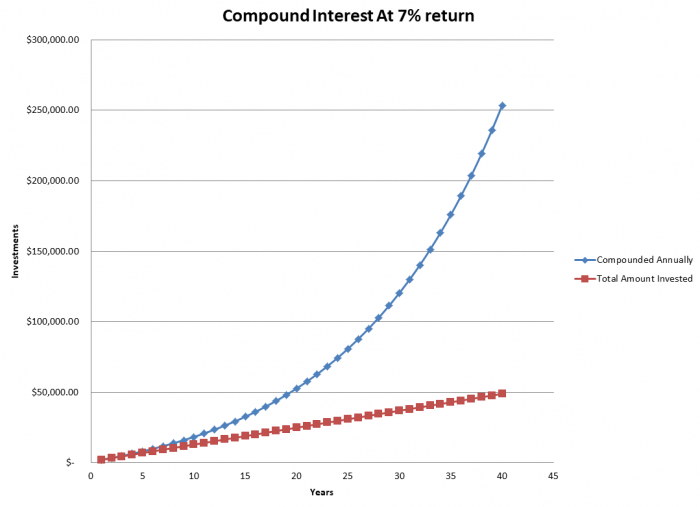

So I’m sure at this point you’re asking yourself, why should I invest my hard earned internship paycheck into a Roth IRA instead of going to Pizza Boys every Tuesday for dollar slices? That’s a very good question. Investing for your retirement is so important, but what many people don’t understand is that the earlier you start to invest the better! The principle of compound interest is on your side the earlier you start. Let me give you an example just to show you how simple the math is when using this online interest calculator.

For the example, we will start with 3 different individuals, for simplicity let’s call them A, B, and C. All three individuals start with an initial balance of $1000 in their Roth accounts. We will stagger when they start investing by 5 years each and they all stop at age 65. Individual A starts when they are 20 and add $100 every month, at 65 they will have $271,305. Individual B will start at 25 and add $100 every month and have an ending balance of $188,172. Lastly, Individual C starts at age 30 and adds the same $100 every month and only comes out with $128,889. Looking at just the numbers, Individual A only invested $6,000 more than individual B and $12,000 more than individual C for the 40 year span; but Individual A came out with $83,000 more than individual B and $142,000 than individual C.

Now that you can see the role that compound interest plays on our lives, you know why it is so important. Obviously, not everyone has the ability to put in $100 a month, but every penny counts, and an earlier start can be the difference between being able to retire at age 40 vs. 65.

Thanks for your time, Kyle Hochbrueckner.